Best Merchant Services For Small Businesses: Direct Processing Network Gateway vs Authorize.net Gateway

Whether you’re running an online store, a brick-and-mortar establishment, or a hybrid of both, you can’t overlook the significance of choosing the right merchant service. In this article, we will deep-dive into two industry giants: Direct Processing Network Gateway and Authorize.net Gateway. By the end, you’ll not only understand what sets them apart but also be well-equipped to make an informed decision tailored to your business needs. So, let’s get down to brass tacks!

What are Merchant Services?

Merchant services refer to various financial services that enable businesses to accept payment transactions through credit and debit cards, mobile payments, or e-commerce systems. This sector involves a host of entities including merchant acquiring banks, payment gateways, point-of-sale systems, and software providers.

Importance for Small Businesses

For small businesses, a dependable merchant service is not just a convenience; it’s a necessity. It enhances customer experience by offering multiple payment options, secures transactions, and keeps the cash flow consistent. Moreover, it opens doors to online sales and international markets.

Direct Processing Network Gateway

Overview and History

Direct Processing Network Gateway is a lesser-known but highly reliable payment processing solution. It gained attention due to its robust direct-to-bank payment channels and competitive pricing. Over the years, it has become a trusted name among small and mid-sized businesses.

Feature Analysis

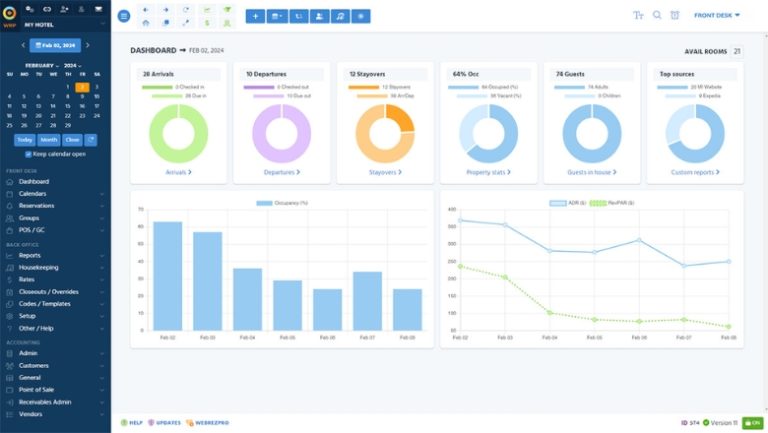

When it comes to features, Direct Processing Network Gateway has a no-nonsense approach. It offers a simplified dashboard, real-time tracking, batch processing, and seamless integration with popular accounting software.

Security Measures

Security is a top priority. It employs end-to-end encryption, tokenization, and anti-fraud detection to safeguard transactions. Additionally, it complies with Payment Card Industry (PCI) security standards.

Pricing Strategy

The pricing model of Direct Processing Network Gateway is straightforward. It offers flat-rate pricing, eliminating the complexities of hidden fees and varying rates. This transparent approach makes it easier for small businesses to budget effectively.

User Reviews

Overall, Direct Processing Network Gateway receives rave reviews from users who appreciate its reliability, secure transactions, and excellent customer support. However, some users have noted that its dashboard could be more intuitive.

Authorize.net Gateway

Overview and History

Authorize.net has been a pioneer in the field of payment gateways since 1996. It stands out for its rich set of features, customization options, and a massive client base that includes both small businesses and large enterprises.

Feature Analysis

Authorize.net Gateway offers a plethora of features, such as recurring billing, mobile payments, and even advanced fraud detection services. Its API allows for greater customization, enabling businesses to tailor the payment experience to their needs.

Security Measures

Authorize.net uses a multi-layered security strategy. It not only adheres to PCI-DSS compliance but also offers advanced fraud detection suites, tokenization services, and secure customer data management.

Pricing Strategy

Authorize.net offers a variety of pricing plans that cater to different business sizes and needs. These range from monthly subscriptions to per-transaction costs, giving you the flexibility to choose what suits your business best.

User Reviews

Users generally praise Authorize.net for its advanced features and scalability. However, some small businesses find its pricing a bit steep and its features overwhelming.

Direct Processing Network Gateway vs Authorize.net Gateway

Speed and Reliability

When it comes to speed and reliability, both platforms are nearly neck-and-neck. However, Direct Processing Network Gateway scores slightly higher on direct bank transactions.

Features Showdown

Authorize.net is the undisputed leader when it comes to features. It offers a variety of bells and whistles that Direct Processing Network Gateway simply cannot match.

Security Comparison

Both platforms offer excellent security measures but Authorize.net Gateway takes it up a notch with its advanced fraud detection suites.

Cost Efficiency

If you’re running a small business and cost is a significant factor, then Direct Processing Network Gateway is a more budget-friendly option.

Choosing the best merchant service for your small business is a critical decision. Both Direct Processing Network Gateway and Authorize.net Gateway have their strengths and weaknesses. Your choice will ultimately depend on your specific business needs—whether it’s the range of features, budget constraints, or security measures that are your top priorities.