Welcome to Direct Processing Network

The Future of Tecnology, Surcharge, & Payments is Already Here.

BUSINESS & PAYMENT SOLUTIONS AT ITS FINEST

Streamline overall operations,

reduce costs, & save time.

We help businesses and organizations achieve more.

State of the Art Customer & Technical Support Packages

All of our systems come with lifetime support.

Expert guidance every step of the process to ensure your success.

Rewards & Benefits

- Dedicated account manager assigned.

- On Demand training for staff & owners.

- Remote support to help you make changes to your system.

- Next day replacements for equipment under warranty.

- Bilingual technical & customer support

- Consultation for system expansions

Rewards & Benefits

- Dedicated account manager assigned.

- Unlimited training for staff & owners.

- Remote support to help you make changes to your system.

- Next day replacements for equipment under warranty.

- Bilingual 24/7 Support.

- Dedicated on-site support. (1-3 hours per month)

- Unlimited virtual support and remote support

- Unlimited support calls

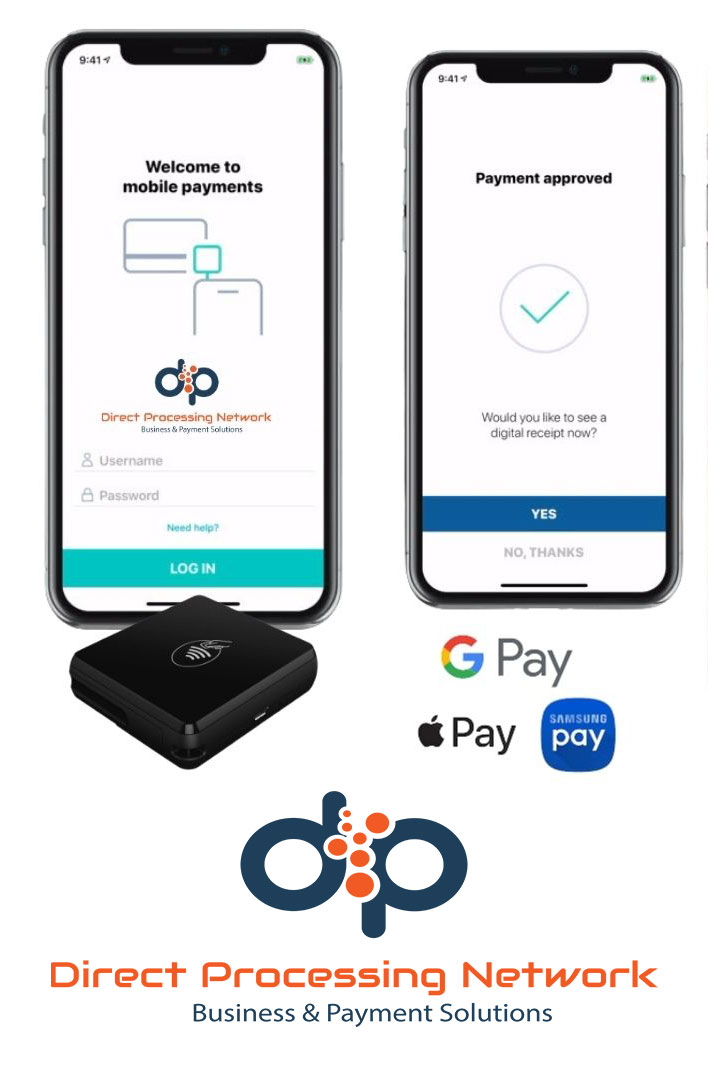

Direct Processing Network MOBILE APP

Secure, convenient payment acceptance with our mobile app.

Operate your accounts on any smartphone or tablet.

Payment System ROI Calculator

Payment System ROI Calculator

| Your Estimated Staff Discount Savings Per Month: | $0.00 |

| Your Estimated Theft Prevention Savings Per Month: | $0.00 |

| Your Estimated Payroll Cost Savings Per Month: | $0.00 |

| Your Estimated Product Waste Savings Per Month: | $0.00 |

direct processing network help center

Frequently Asked Questions

Got a question about how we’re organised, our products and services, applying to work for us, or looking for financial or shareholder information?

How are my funds protected?

Direct Processing Network utilizes several security measures including fraud, loss, and chargeback prevention. Our global gateway uses Secure Sockets Layer (SSL) technology and encryption procedures to ensure the highest standards of security in the market.

What should I do if I need help with my account?

If you have any questions or doubts in regards to your rates, fees, services, statements, or a specific transaction, please contact our office at 1-855-955-6111 or via email at info@floridapayments.com. In addition, you can log into your My Merchant Office account

How can I add an entitlement to my account, for instance American Express?

Go ahead and contact our customer support department at 1-855-955-6111. They will explain the process and email you an entitlement addendum. This addendum will display all of the rates and fees that are involved in adding the new feature. Once we receive the document, we will forward it and process it for approval. You can also reach our customer support at info@floridapayments.com

What exactly are non-qualified fees and why are we billed for them?

The fees applied to your account are based on the qualification of your transactions for specific and reduced interchange fees as applicable for the card affiliated with the transaction. If any of your transaction doesn’t qualify for the reduced interchange fee, the transaction is then processed at the higher applicable interchange rate.

There are several reasons for receiving non-qualified fees. Such as hand-keying transactions into the terminal in face-to-face scenarios, not entering address information and card verification codes for keyed transactions, settling transactions more than 24 hours from the time the card was authorized, and sometimes accepting a corporate/business card. Non-qualified fees are processed and billed through Visa and MasterCard, and they can be avoided. For further information please contact us at 1-855-955-6111 or via email at info@floridapayments.com

I am receiving a “decline” message from my terminal. What does this message mean?

The customer’s bank is declining the transaction. This can be for several reasons including unauthorized use, lack of funds on the card, or fraud prevention measures applied by the card holder’s bank. You will need to ask for another form of payment and ask the cardholder to contact their bank with any further questions.

How long does it take for my account to be funded for my transaction deposits?

The funding to your account for most card classes takes place within 24-48 hours. This may vary based on your banking institution and in which the transactions are completed. (Weekends or holidays may take longer)

How can I obtain information on deposits and chargebacks?

You can contact us at 1-855-955-6111 for this information or login to your merchant account back office at www.copilot.cardconnect.com

Some Of Our Successful & Satisfied Clients

Clients' Reviews

EXCELLENTTrustindex verifies that the original source of the review is Google. Jose has an awesome personality and explains everything clearly about the POS world that he is in. He hears what you say and he sees what you need. He offers options and he works with you on your side.Trustindex verifies that the original source of the review is Google. DPN is the BEST merchant services and point of sale systems in Coral Gables. They make everything easy and simple, from explaining what they will do, thru installation and using the system and getting your money. It's exactly what you want from the service.Trustindex verifies that the original source of the review is Google. The best mobile POS systems in West Palm Beach. Jose and his team provide excellent customer support!Trustindex verifies that the original source of the review is Google. It’s been nothing but a pleasure working with Jose and his team. They care about the small business owners, and I’ve benefited a lot from his Pos systemTrustindex verifies that the original source of the review is Google. DPN has the best personalized expertise I have found. It's been great to work with DPN for all merchant processing needs. Using the very best processing provider is one of the most important business decisions, so I rely on DPN.Trustindex verifies that the original source of the review is Google. Excellent and fast service! Melina and Jose were great to work with. I love my new POS system. Thank you!Trustindex verifies that the original source of the review is Google. Best merchant services and POs systems in all of South Florida!Trustindex verifies that the original source of the review is Google. I was surprised by how very simple it was to implement so I could keep my business ongoing without delay. A big, warm thank you to Jose who made this all possible for me. I am now saving money and have way a smoother process with the POS especially compared to the mess I had before. Thanks again to Jose and my only regret is not switching to this company earlier.Trustindex verifies that the original source of the review is Google. Very professional and honest